massachusetts estate tax table

The estate tax is a transfer tax on the value of the decedents TAXABLE estate before distribution to any beneficiary. Connecticut S Estate Tax.

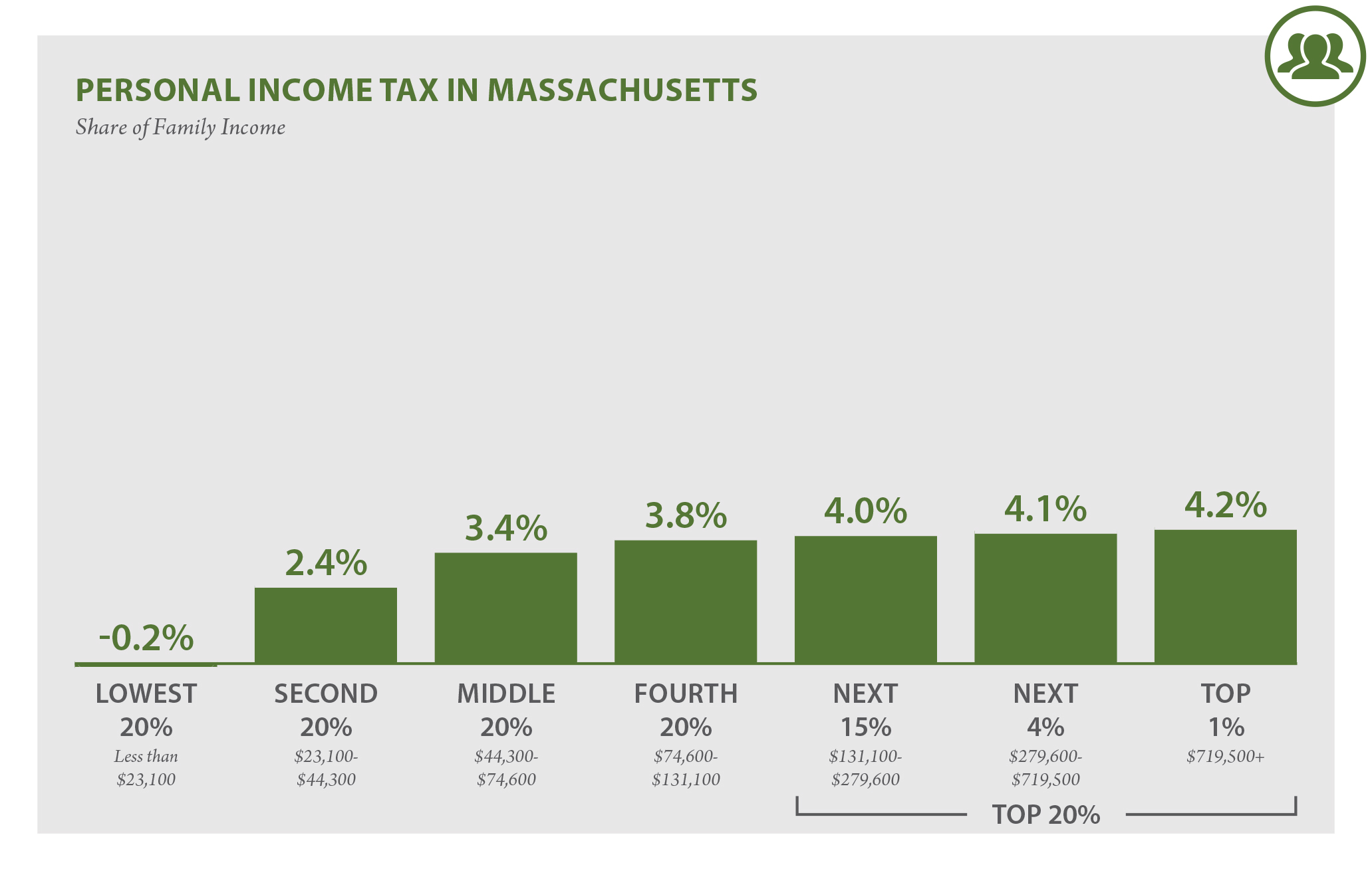

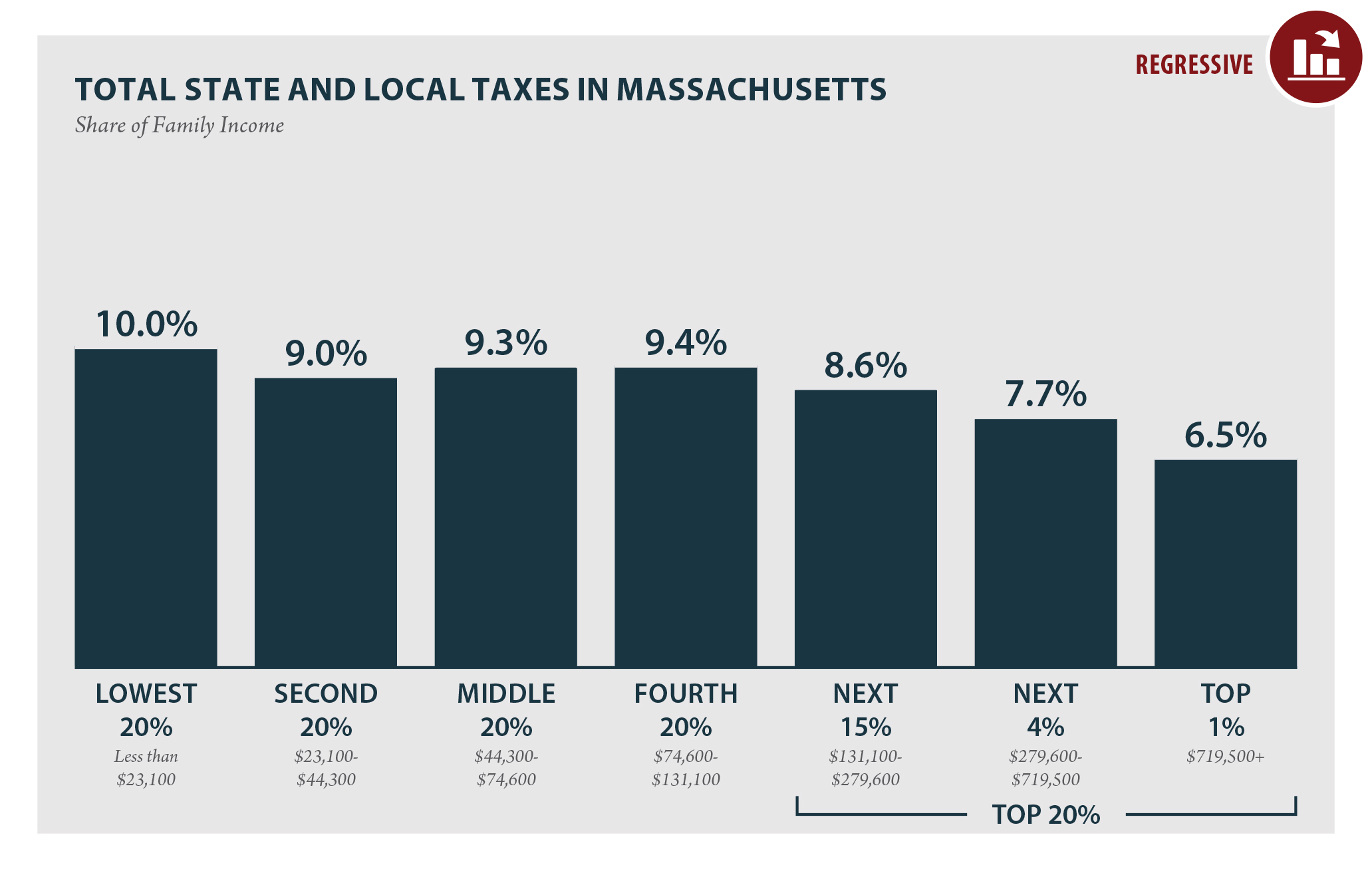

Massachusetts Who Pays 6th Edition Itep

Killing estate ta estate ta or inheritance tax debate massachusetts estate and gift ta.

. We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Additionally because the taxable estate of 1050000 exceeds 1000000 the estate tax due is 20500. Up to 25 cash back If youre a resident of Massachusetts and leave behind more than 1 million for deaths occurring in 2022 your estate might have to pay Massachusetts estate tax.

For estates of decedents dying in 2006 or after the applicable exclusion amount is 1000000. Future changes to the federal estate tax law have no impact on the Massachusetts estate tax. All printable Massachusetts tax forms are in PDF.

The Massachusetts taxable estate is 940000 990000 less 50000. Calculating the estate tax as if the decedent had been a resident of Massachusetts. Example - 5500000 Taxable Estate - Tax Calc.

Whether the estate is. Masuzi July 19 2018 Uncategorized Leave a comment 8 Views. This tool is provided to help estimate potential estate taxes and.

Your estate will only attract the 0 tax rate if. You can use the button below to schedule your consultation or simply give us a call at 781-784-2322 or fill out our web form. Massachusetts Tax Forms 2020 Printable State Ma Form 1 And Instructions.

So even if your estate isnt large enough to. State By Estate And Inheritance Tax Rates Everplans. We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Why More States Are Killing Estate Ta Familywealth 17. The Massachusetts State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Massachusetts State Tax Calculator. In general an estate of 11 million will pay about 40000 in Massachusetts estate tax.

The Massachusetts estate tax is calculated by. The Massachusetts Estate Tax applies to individuals with assets worth over 1 Million and the tax rate varies. An estate of 5 million will pay about 400000.

Was enacted in 1975 and is applicable to all estates of decedents dying on or after January 1 1976. An estate of 2 million will pay about 100000 of tax. Computation of the credit for state death taxes for Massachusetts estate tax purposes.

The Massachusetts State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Massachusetts State Tax Calculator. The imposed Massachusetts estate tax is determined by the percentage of the taxable estate which is real and tangible property located in Massachusetts. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed.

402800 55200 5500000-504000046000012 Tax of 458000 Thoughtful estate planning is very important especially for those that wish to leave assets to their beneficiaries or heirs without being impacted by significant taxes. 2020 Massachusetts State Tax Tables. Calculating the Massachusetts estate tax is a two-step process.

Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16. We have a simple process for getting you from wherever you are now to executed and final documents. The Massachusetts estate tax is a transfer tax imposed on the value of all property in the estate of a decedent at the date of death and not on the value of property received by each beneficiary.

If a person is subject to both the Federal and State tax then their marginal estate tax rate could be 45 or more. The rate ranges from 8 to 16. However for most individuals who have assets between 1M and 5M then the tax rate hovers anywhere from 0 to 20.

8400 27600 36000 tax However 36000 exceeds. Massachusetts estate tax brackets range from 08 to 16 for estates over 10 million. What To Know About The 2020 Estate Tax Exemption In Massachusetts Ladimer Law Office Pc.

Calculating the ratio of the Massachusetts situs real and. 2021 Massachusetts State Tax Tables. Therefore a Massachusetts estate tax return is required because the sum of the decedents gross estate at death and the adjusted taxable lifetime gifts exceeds 1000000.

1050000 - 60000 990000. Massachusetts Estate Tax Table 2017. A guide to estate taxes Mass Department of Revenue The adjusted taxable estate used in determining the allowable credit for state death taxes in the table is the federal taxable estate total federal gross estate minus allowable federal deductions less 60000.

1 a personal representative must determine whether an estate tax return Form M-706 must be filed ie. It starts with an initial consultation which is absolutely free. The Massachusetts tax is different from the federal estate tax which is imposed only on estates worth more than 1206 million for deaths in 2022.

The estate tax is computed in graduated rates based on the total value of the estate. The Massachusetts estate tax law MGL. Massachusetts Estate Tax Rates Highlighted Section.

We are ready to help. A Massachusetts estate tax return Form M-706 is required to be filed because the decedents gross estate prior to deductions exceeds the threshold.

Massachusetts Estate Tax Everything You Need To Know Smartasset

States With Highest And Lowest Sales Tax Rates

Is Ab Trust Planning Still Effective

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

A Guide To Estate Taxes Mass Gov

Massachusetts Who Pays 6th Edition Itep

Massachusetts Who Pays 6th Edition Itep

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

What Are Estate And Gift Taxes And How Do They Work

Massachusetts Estate And Gift Taxes Explained Wealth Management

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Massachusetts Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Massachusetts Estate Tax Everything You Need To Know Smartasset

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)